Ad Online access to property records of all states in the US. Find answers to the a list of common questions other users have asked.

Start Your Homeowner Search Today.

Maricopa county arizona property assessor. Maricopa County Assessor 301 West Jefferson Street Phoenix AZ 85003 Maricopa County Assessor Phone Number 602 506-3406. 301 West Jefferson Street Phoenix Arizona 85003 Main Line. Please contact the Maricopa County Treasurers Office at 602 506-8511.

The Maricopa County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Maricopa County and may establish the amount of tax. Maricopa County Property Records are real estate documents that contain information related to real property in Maricopa County Arizona. View various years of aerial imagery for Maricopa County dating back to.

You can filter the results to a particular category or properties and services using the Filter by Category option below. The last ninth digit and dashes are not necessary to complete the search on this website. Ad Get In-Depth Property Tax Data In Minutes.

View public property records including property assessment mortgage documents and more. It is an identifier for Assessor Parcel Maps that corresponds to the Township Range Section. Property owner deadline to file 2020 Notice of Valuation with Tax Court.

The Maricopa County Assessors Office located in Phoenix Arizona determines the value of all taxable property in Maricopa County AZ. Maricopa County Assessor Address. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the taxpayer.

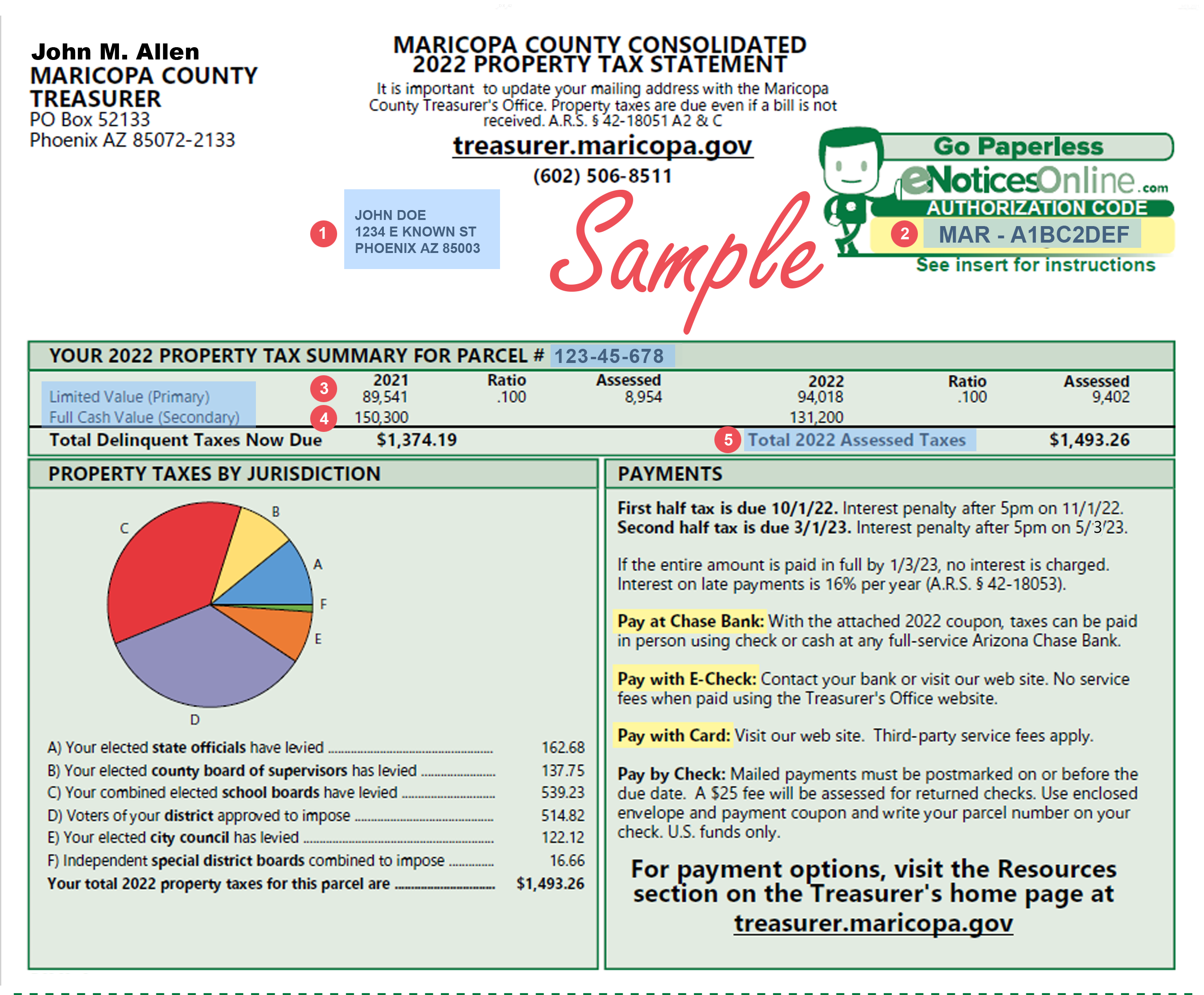

Maricopa County Assessors Office. Your parcel number can be located at the top of your tax statement in the format shown below. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free.

Eddie Cook was appointed Maricopa County Assessor in February 2020 elected in November 2020 and sworn in for his four-year term in January 2021. Prior to becoming assessor Eddie. Form 140PTC is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in Arizona that is either owned by or rented by the.

The Assessor annually notices and administers over 18 million real and personal property parcelsaccounts with a full cash value. We recommend upgrading to the. The Maricopa County Treasurer sends out the property tax bills for local jurisdictions this includes the county cities school districts special taxing districts and the state not just.

Public Property Records provide information on. Search Valuable Data On A Property. Such As Deeds Liens Property Tax More.

More information can be found at Tax Court or Small Claims Court at 125 W Washington Phoenix AZ or call 602-506. Taxable property includes land and commercial. PlanNet has been developed to provide easy access to the information and maps associated with the zoning annexations floodplain and other delineations within Maricopa County.

Welcome to Maricopa County the 4th populous county in the nation with over 13000 employees working together to continually improve residents quality of air environment public health. Ad Find Your Homes Current Market Value With A Free Estimate From A Local Expert In AZ. View which parcels have overdue property taxes and unsold liens.

301 West Jefferson Street Phoenix Arizona 85003 Main Line. Your browser is currently not supported. What is a MapID.

Please note that creating presentations is not supported in Internet Explorer versions 6 7.

How Do I Pay My Taxes Maricopa County Assessor S Office

Page 1 Of 1 Document Sign Accounting Information Update All

How Do I Pay My Taxes Maricopa County Assessor S Office

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcro6ese4ysplw Dqzmxhpmlro6htrgn 8jzeq Euptk0xlbcawj84t Usqp Cau

Comments